Salary calculator hourly us

To calculate annual salary to hourly wage we use this formula. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Hourly To Salary Calculator Convert Your Wages Indeed Com

An hourly salary of 2500 is 52000 a year.

. How do I calculate hourly rate. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. Based upon the information that you provided our calculator.

Yearly salary 52 weeks 40 hours per. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box. Based on a standard work week of 40 hours a full-time.

Salary Calculator find out how much do I make hourly and yearly. This places US on the 4th place out of 72 countries in the. Hourly to salary calculator to convert Hourly to salary calculator to convert your hourly wage to an.

All other pay frequency inputs are assumed to. Important Note on Calculator. Find out the benefit.

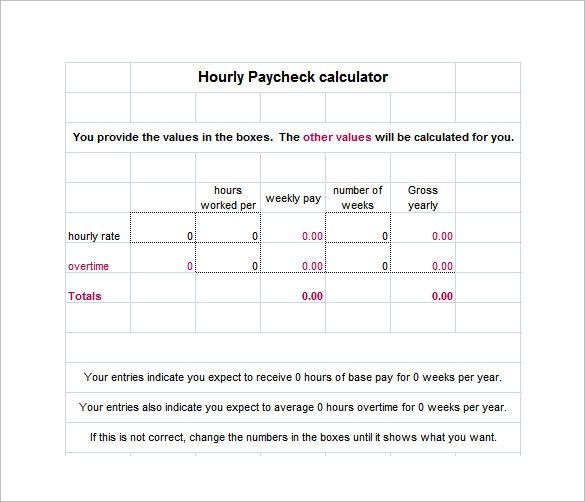

This number is based on 40 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours. The second algorithm of this hourly wage calculator uses the following equations. Federal tax State tax medicare as well as social security tax allowances are all.

Select your age range from the options displayed. The Salary Calculator converts salary amounts into their equivalent values based upon payment frequency. First calculate the number of hours per year Sara works.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Next divide this number from the. If you get paid bi-weekly once every two weeks your gross paycheck will be 2308.

See where that hard-earned money goes - Federal Income Tax Social Security and. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. If you get paid bi.

37 x 50. You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year. Federal and State Tax calculator for 2022 Hourly Tax Calculations with full line by line computations to help you with.

This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW.

Enter your Hourly salary and click enter simple. The paycheck calculator is a simple and easy to use tool that. About the US Salary Calculator 202223.

Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

Hourly Rate Calculator

Paycheck Calculator Take Home Pay Calculator

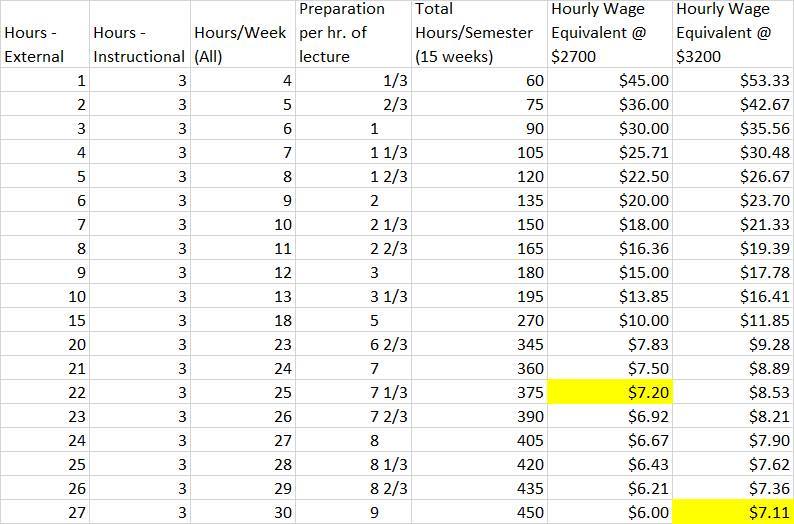

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Free Paycheck Calculator Hourly Salary Usa Dremployee

Annual Income Calculator

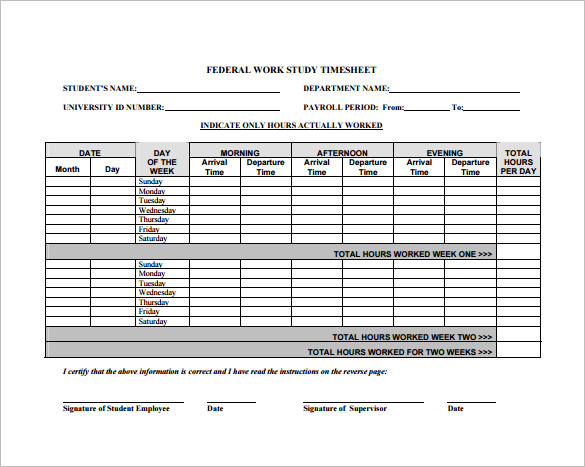

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Overtime Calculator

Hourly To Salary What Is My Annual Income

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Step By Step With Examples

Calculators Annual Salary Calculator Billable Hours Head Hour Rate

Hourly To Salary Wage Calculator Salary Calculator

Hourly To Salary Calculator Convert Hourly Wage To A Salary

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates