Diminishing value depreciation formula

The double declining balance formula. Unless its a highly sought-after vintage model most cars lose value over time also known as diminishing value.

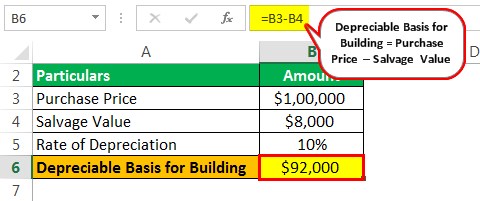

Depreciation Of Building Definition Examples How To Calculate

2000 - 500 x 30 percent.

. Depreciation is the loss in the value of a form of wealth through wear and tear or the passage of time. It is an internal analysis metric used by the organizations along with the accounting profits. Decline because future payments are discounted their PV reduced by more.

Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100. The adjusted tax book value at the end of the. Suppose a photocopier has a useful life of three years.

Each year you claim for the item the base value reduces by that amount. 023 x 2k05 09014k. For buildings that were owned by the taxpayer in the 201011 income year will be.

The original value of the asset plus any additional costs required to get the asset ready for its intended use. If the population growth is 9 and the pre-laborer production rate is 2k05 the company can use the following formula. To calculate depreciation for most assets for a particular income year.

The rate of depreciation is 30 percent. Declining Balance Method. Diminishing value method.

103 Impatience and the diminishing marginal returns to consumption. Thus formula for calculating depreciation expense as per this method is as follows. The formula for the annual decline in value using the diminishing value method is.

Read more yellow line starts to. It is calculated by dividing the change in the costs by the change in quantity. Depreciation expense Book value of the asset at the beginning of the year x Rate of depreciation.

Base value days held 365 200 asset. If your car was originally worth 15000 was involved in a. After the initial decrease the marginal cost Marginal Cost Marginal cost formula helps in calculating the value of increase or decrease of the total production cost of the company during the period under consideration if there is a change in output by one extra unit.

Assets cost days held 365 200 assets effective life The decline in value for 202122 is 602 worked out as follows. Economic value added EVA is the economic profit Economic Profit Economic profit refers to the income acquired after deducting the opportunity and explicit costs from the business revenue ie total income minus overall expenses. The diminishing value formula is as follows.

Net national product NNP is the total value of finished goods and services produced by a countrys citizens overseas and domestically minus depreciation. Opening tax book value The opening tax book value for the beginning of the 2020-21 income year. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method.

The salvage value formula requires information like purchase price of the machinery depreciation amount mode of depreciation expected life of the machinery etc. The formula used to calculate this method is. A diminishing value calculation assumes the asset depreciates quicker at the start of its life so you claim more in the beginning than in subsequent years.

To get that first calculate. Reducing Balance Method Formula. Also known as scrap or salvage value this is the value of the asset once it reaches the end of its useful life.

If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is. The asset cost 2000 and youll be able to sell it for 500 when youre through with using it. Scrap Value is equal to 400000 known as depreciable cost or depreciable value.

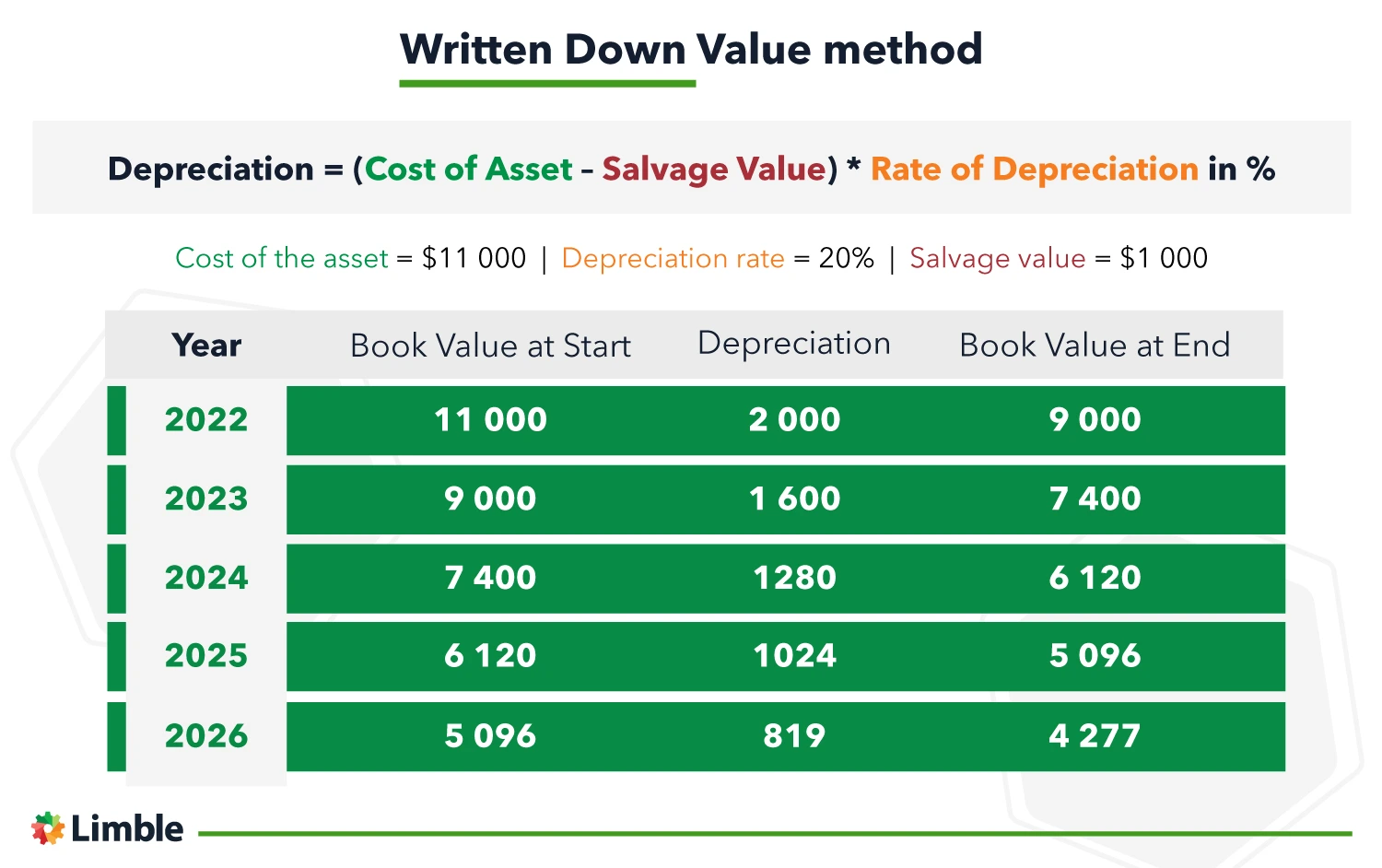

The depreciation rate for non-residential buildings is 2 diminishing value or 15 straight-line. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset.

Base value x days held 365 x 200 assets effective life Example. Note that it is easy to adjust the present value formula to take into account different. Economic Value Added EVA concept.

A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. This is because newer models are worth more and because the wear and tear on the vehicle makes it less reliable in the long run. Under this method depreciation charge is estimated based on the number of units produced by an.

Now the depreciation formula for the straight-line method will be. More How National Income Accounting Works. Diminishing Value Depreciation Method.

Units of Production Method. 2 x basic depreciation rate x book value. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25.

This correlates to the percentage the asset will depreciate by each year. Example Diminished Value Formula. Laura is entitled to a deduction for decline in value of 600.

To get the actual value of the scrap or the salvage amount of the machinery. According to Reducing Balance Method the percentage at which depreciation is charged remains fixed and the amount of depreciation goes on diminishing year after year. It means that we cannot charge depreciation on scrap value 100000 which is assumed the assets.

Double declining balance is calculated using this formula. These are Straight-line depreciation and Diminishing balance method of depreciation. Marginal Benefit 11250 5000 15 5 Marginal Benefit 625 per chocolate Since the next set of chocolates are priced higher 625 than what the consumer in willing to pay 5 he will not buy the next 10 chocolates.

The adjustable value of the asset on. Diminishing balance or Written down value or Reducing balance Method. Depreciation Expense Cost of Asset Scrap value Useful life time.

Base value days held 365 150 assets effective life Reduction for non-taxable use. Cost of the asset recovery period. If an asset costs 50000 and has an effective life of 10 years your first years deduction will be.

Diminishing Balance Method. A roofing company realizes the depreciation rate of its materials is 17 while the business experiences 13 population. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

MobilePortable Computers including laptops and tablets effective life of 2 years from 1 July 2016 Under the depreciation formula this converts to a Diminishing Value percentage rate of 100 or Prime Cost 50. After solving for k the capital-labor ratio is 4.

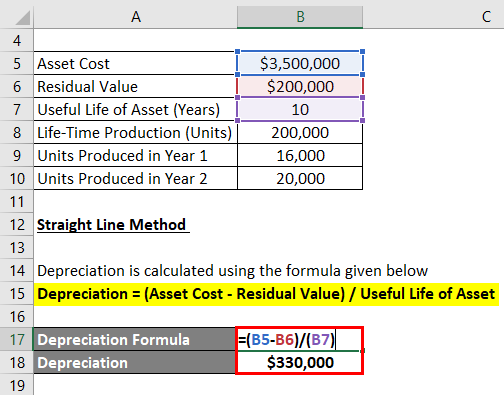

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Method Diminishing Method

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Equipment Depreciation Basics And Its Role In Asset Management

Youtube Method Class Explained

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation All Concepts Explained Oyetechy

Double Declining Balance Depreciation Calculator

Depreciation Formula Examples With Excel Template